Rental Property Expenses Spreadsheet: Track Every Deductible Dollar

A rental property expenses spreadsheet categorizes every cost by IRS Schedule E line item, so you capture every deduction and don't scramble to reconstruct 12 months of expenses in March.

The average self-managing landlord misses $1,000-3,000 in annual deductions. Most of those missed deductions come from expenses that were real, paid, and legitimate, but never recorded.

The Complete Expense Category List

The IRS allows these deductions on Schedule E for rental properties. Your spreadsheet needs a row or category for every one. If you're already using a rental property spreadsheet to track portfolio performance, this expense layer sits alongside it.

Fixed Monthly Costs

Variable Operating Costs

Professional Services

Travel & Administrative

Capital & Depreciation

Worked Example: 4-Property Portfolio Annual Expenses

Here's what a real expense spreadsheet looks like for a landlord with 4 single-family rentals worth a combined $680,000.

Property Details

Annual Expense Summary

At a 24% marginal tax rate, $61,775 in deductions saves $14,826 in taxes. Miss 10% of those deductions and you're overpaying the IRS by $1,483/year.

The Three Mistakes That Cost Landlords $1,000+/Year

1. Not tracking mileage

Every trip to your rental property is deductible at 70 cents per mile. Ten trips at 20 miles round-trip = $140 in deductions per property.

With 4 properties and 8-12 trips each per year, that's $560-840 in mileage deductions. Most landlords track zero of this because they forget to log the trip when it happens.

Fix: Use a mileage app (MileIQ, Everlance) or add a "Mileage" column to your expense log. Record the date, property, and miles driven for every trip, even 5-minute runs to drop off a key.

2. Lumping repairs and improvements

A repair restores something to working condition and is fully deductible this year:

- Fixing a leaky faucet: $180 repair (deduct now)

- Patching drywall: $250 repair (deduct now)

- Replacing a broken garbage disposal: $350 repair (deduct now)

An improvement adds value or extends useful life and must be depreciated over 27.5 years:

- New roof: $8,500 improvement (deduct $309/year for 27.5 years)

- Kitchen renovation: $15,000 improvement (deduct $545/year for 27.5 years)

- New HVAC system: $6,000 improvement (deduct $218/year for 27.5 years)

Miscategorizing a $3,000 repair as an improvement costs you $2,891 in immediate deductions. You'd only claim $109 this year instead of the full $3,000.

Fix: Add a "Repair or Improvement?" column to your spreadsheet. If it restores existing function → repair. If it makes the property better than before or extends useful life → improvement.

3. Forgetting small purchases

That $47 deadbolt. The $23 in smoke detector batteries. The $89 locksmith call. The $35 in cleaning supplies between tenants.

These individually feel too small to record. Across 4 properties and 12 months, they add up to $500-1,200/year in deductions that never make it into your spreadsheet.

Fix: Keep a dedicated credit card for rental expenses. Every charge on that card goes into the spreadsheet. No mental filter for "is this worth recording?": everything gets logged.

Tracking expenses is half the picture. The other half: knowing whether your rents are keeping pace with market, is where most landlords are blind. Operator monitors your rents against live market comps across your entire portfolio. When you're leaving money on the table, you see it. $25/mo.

Spreadsheet Structure That Actually Works

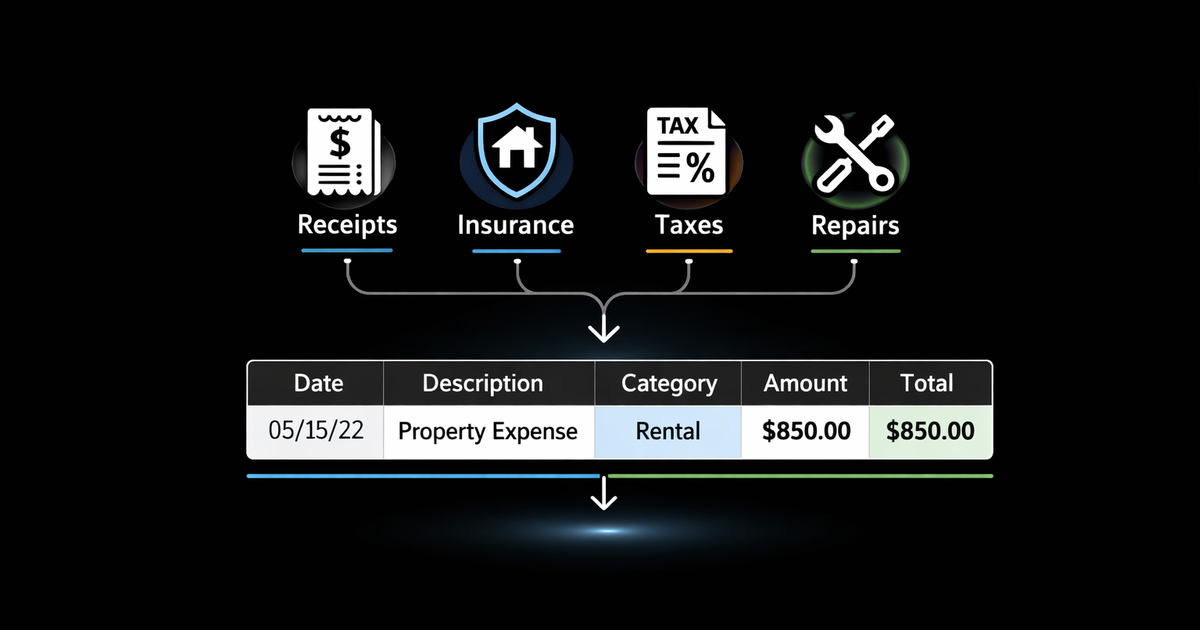

Tab 1: Expense Log

Every expense gets one row:

Tab 2: Monthly Summary

Pivot table or SUMIFS pulling from the Expense Log, grouped by property and category. This is your dashboard, glance at it monthly to catch anomalies.

A spike in one property (like Prop C in March) tells you to investigate. Maybe it's a one-time repair. Maybe it's a pattern.

Tab 3: Year-End Report

One-click summary matching IRS Schedule E, sorted by property. Hand this to your CPA and save 2-3 hours of back-and-forth.

Critical rule: Enter expenses weekly, not quarterly. The landlord who waits until March to organize expenses is the landlord who misses 20% of deductions.

When Your Spreadsheet Needs More Than a Spreadsheet

Expense tracking works in a spreadsheet. What doesn't work in a spreadsheet:

Knowing if your rents are at market. You're diligently tracking $46K in expenses, but you have no idea whether your $1,200/month Memphis rental should be $1,350. That $150/month gap is $1,800/year in missed income, more than most expense tracking errors.

Seeing your portfolio as a portfolio. A spreadsheet shows you Property B had $2,400 in repairs. It doesn't tell you that Property B's cash-on-cash return dropped from 6.2% to 3.8% because of those repairs combined with stale rent pricing.

Spotting below-market rents across multiple properties. If you own 4-10 properties in 2-3 markets, manually checking rent comps for each one every quarter is a 4-6 hour project. Most landlords don't do it. The result: rent erosion that compounds across the portfolio.

Operator doesn't replace your expense spreadsheet, it fills the gap your spreadsheet can't. Live rent monitoring, portfolio-level performance tracking, and alerts when your rents fall below market. You keep tracking expenses. Operator makes sure the income side isn't silently eroding. $25/mo.

Expense Benchmarks by Property Type

Use these as sanity checks when reviewing your annual numbers:

If your total expenses consistently run below 35% of gross rent, you're probably under-budgeting repairs or CapEx. If above 60%, either your rents are too low or your properties need significant capital investment. Either way, these numbers feed directly into your cash flow analysis.

Operator's deal analysis calculator uses these same expense benchmarks, customized to your actual property data. Run the numbers on any address with Operator. $25/mo.

FAQ

What expenses can I deduct for a rental property?

Deductible rental property expenses include mortgage interest, property taxes, insurance, property management fees, repairs, maintenance, utilities (if landlord-paid), professional services (legal, CPA), mileage at 70 cents/mile, advertising, and depreciation over 27.5 years. All deductible expenses are reported on IRS Schedule E. Principal payments and capital improvements are not immediately deductible.

What is the difference between a repair and an improvement for taxes?

A repair restores something to working condition (fixing a leaky faucet, patching drywall, replacing a broken disposal) and is fully deductible in the current year. An improvement adds value or extends useful life (new roof, kitchen renovation, new HVAC) and must be depreciated over 27.5 years. Miscategorizing a $3,000 repair as an improvement defers $2,891 in deductions you could claim this year.

How often should I update my rental property expenses spreadsheet?

Update weekly. Landlords who wait until month-end or tax time typically miss 15-20% of deductible expenses because receipts get lost, small purchases are forgotten, and mileage goes unrecorded. Weekly entry takes 10-15 minutes across a 4-property portfolio. Use a dedicated credit card for rental expenses to simplify recording.

What percentage of rental income goes to expenses?

Total operating expenses typically run 40-55% of gross rental income for residential investment properties. This includes property taxes (10-20%), insurance (5-10%), repairs (5-10%), CapEx reserves (5-10%), property management (8-10%), and vacancy (5-8%). If your expenses consistently run below 35%, you're likely under-budgeting maintenance or CapEx.

Does Operator track rental property expenses?

Operator is not expense tracking or bookkeeping software. It monitors your portfolio's performance from the income side, tracking your rents against live market comps, calculating cash flow and cash-on-cash return, and alerting you when rents fall below market. Use your expense spreadsheet for cost tracking, and Operator for ensuring your rental income isn't silently eroding. $25/month.