Rental Property Analysis Spreadsheet: Evaluate Deals in 10 Minutes

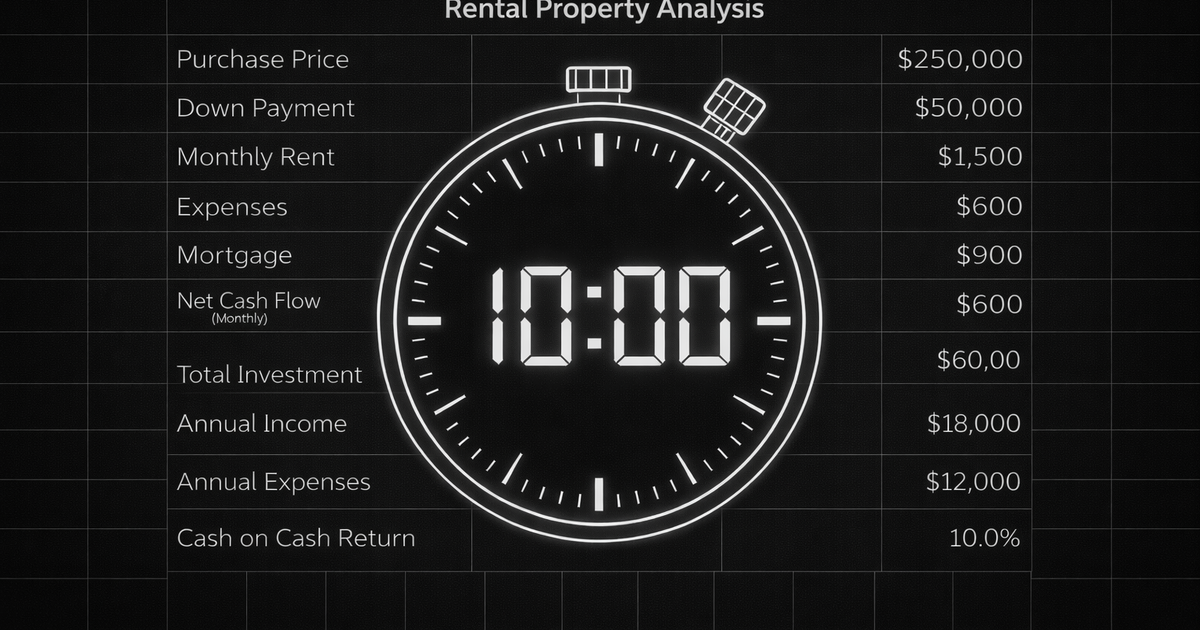

A rental property analysis spreadsheet calculates cash flow, cap rate, cash-on-cash return, and DSCR from property inputs, giving you a buy/pass decision in 10 minutes instead of 2 hours of back-of-napkin math.

The 5 Numbers That Determine Every Deal

Every rental analysis comes down to five metrics. Your spreadsheet should calculate all five automatically from the same inputs.

1. Monthly Cash Flow

Formula: Gross Rent − All Expenses − Mortgage Payment

- Positive cash flow = property pays for itself

- Target: $200+ per door for single-family, $100+ per unit for multifamily

- Below $100/month: one vacancy or one repair wipes out a full year of profit

2. Cap Rate

Formula: (Annual NOI ÷ Purchase Price) × 100

- Measures return independent of financing

- 5-7% cap: typical for stable markets (Phoenix, Dallas, Tampa)

- 7-10% cap: higher cash flow markets (Memphis, Cleveland, Indianapolis)

- Below 5%: you're betting on appreciation, not cash flow

3. Cash-on-Cash Return

Formula: (Annual Cash Flow ÷ Total Cash Invested) × 100

- Measures return on YOUR money, including leverage

- Target: 8-12% for buy-and-hold

- Below 6%: your money earns similar returns in index funds with zero landlord headaches (see our guide on what makes a good cash-on-cash return)

- Above 15%: double-check your assumptions

4. DSCR (Debt Service Coverage Ratio)

Formula: NOI ÷ Annual Debt Service

- Lenders require 1.20-1.25 minimum for investment property loans

- Below 1.0: property doesn't cover its own debt

- Above 1.5: strong buffer for vacancies and repairs

5. The 1% Rule (Quick Filter)

Formula: Monthly Rent ÷ Purchase Price

- 1% or higher: likely cash flows at current rates (see our 1% rule breakdown)

- 0.8-1%: might work with low taxes/insurance

- Below 0.7%: rarely cash flows in any scenario

Inputs Your Spreadsheet Needs

Your spreadsheet is only as good as its inputs. Here's what goes in, organized by tab.

Property Data

Financing Assumptions

Operating Expenses

Worked Example: $195,000 Single-Family Rental

Let's run the full analysis on a 3-bed/2-bath in Indianapolis listed at $195,000 with estimated rent of $1,650/month.

Step 1: Calculate NOI

Step 2: Calculate mortgage payment

- Loan amount: $195,000 × 75% = $146,250

- Rate: 7.25%, 30-year fixed

- Monthly P&I: $998

Step 3: Calculate all five metrics

Verdict: Pass. This property doesn't cash flow with professional management at current rates. The DSCR is below 1.0, meaning it can't cover its own debt service.

What Would Make This Deal Work?

Your spreadsheet should have a sensitivity tab that answers this question automatically.

At $195,000 and 7.25%, no scenario with professional management produces meaningful cash flow. You'd need a purchase price around $160,000 or rent closer to $1,900 to see 8%+ CoC return.

This is exactly why running the spreadsheet matters. The listing looks reasonable. The math says otherwise.

Operator runs this analysis automatically using live rent comps, not Zillow estimates, not stale data from 6 months ago. Enter a property address and get cash flow, cap rate, CoC, and DSCR calculated from current market rents. $25/mo.

Red Flags Your Spreadsheet Should Auto-Flag

Build conditional formatting or warning rules for these:

Cash flow under $100/month: One repair or one vacancy month = break-even year. You're working for free.

DSCR under 1.25: You won't qualify for most investment property loans. Even if you have the cash to buy outright, a sub-1.25 DSCR signals the property barely covers its costs.

Cash-on-cash under 6%: Your money earns similar returns in a total stock market index fund with zero landlord headaches, no vacancy risk, and perfect liquidity.

Vacancy at 0%: No property achieves 0% vacancy over a 10-year hold. Budget 5% minimum, 8% in markets with seasonal demand.

Repairs at $0: Every property needs repairs. Budget 1% of property value annually at minimum. Older properties (pre-1980) need 1.5-2%.

Rent estimate without comps: If your rent number comes from the seller, the listing agent, or your gut, it's wrong. Pull actual comps for the same bedroom count, condition, and neighborhood within the last 90 days.

Worked Example 2: A Deal That Works

Same market, different property. A 3-bed/1.5-bath in a B-class Indianapolis neighborhood listed at $155,000 with comps showing $1,550/month rent.

Still thin with management. But self-managed, cash flow is $175/month ($2,100/year), and the CoC rises to 4.8%. If you negotiate the price to $145,000 and self-manage, CoC jumps to 7.2% with a 1.07% rent-to-price ratio.

The difference between the $195K property and the $155K property is obvious in a spreadsheet. Without one, both "look like deals." Only one is.

Tired of building a new spreadsheet for every property? Operator saves your analysis for every deal you've evaluated, pass or buy. Build a library of deals so you can spot patterns in what works in your target market. $25/mo.

Beyond the Buy: Post-Purchase Monitoring

Your analysis spreadsheet answers one question: should I buy this property?

But what about 18 months after you close? Your $200/month cash flow property might be $50/month if:

- Market rents rose 12% and you didn't raise rent at renewal

- Property taxes increased after reassessment

- Insurance premiums jumped 20% (common in storm-prone states)

A deal that passed analysis on Day 1 can silently erode without ongoing monitoring. The most costly version of this: your rents are $200/month below market across 5 properties. That's $12,000/year in missed cash flow, and at a 7% cap rate, $171,000 in suppressed portfolio value.

Operator monitors your existing portfolio against live market comps and alerts you when rents fall below market. You don't need another spreadsheet for post-purchase tracking, you need live data. $25/mo for unlimited properties.

FAQ

What should a rental property analysis spreadsheet include?

A rental property analysis spreadsheet should calculate five core metrics: monthly cash flow, cap rate, cash-on-cash return, DSCR, and the 1% rent-to-price ratio. Required inputs include purchase price, estimated rent (from market comps), property taxes, insurance, financing terms, and operating expense percentages for vacancy (5-8%), repairs (1% of value), CapEx (1%), and property management (8-10%).

What is a good cash-on-cash return for rental property?

Target 8-12% cash-on-cash return for buy-and-hold rental properties. Below 6%, your capital earns similar returns in passive index funds without landlord responsibilities. Above 15% is excellent but verify your assumptions, overly optimistic rent or expense projections can inflate this number. At 2026 interest rates (7%+), achieving 8%+ CoC requires either lower purchase prices or self-management.

How do I estimate rent for a property I haven't bought yet?

Pull actual rental comps: not Zillow Zestimates, for the same bedroom count, similar condition, and within the same neighborhood, ideally from the last 90 days. Check Zillow rentals, Apartments.com, and Craigslist for active listings. Operator's rent estimator pulls live market comps for any address, eliminating the guesswork that makes or breaks your analysis.

What is DSCR and why does it matter?

DSCR (Debt Service Coverage Ratio) = Net Operating Income ÷ Annual Debt Payments. A 1.25 DSCR means the property generates 25% more income than its mortgage costs. Most investment property lenders require 1.20-1.25 minimum. Below 1.0 means the property doesn't cover its own debt, you're feeding it cash every month.

How does Operator compare to a rental property analysis spreadsheet?

A spreadsheet analyzes deals before you buy, you input numbers manually and get metrics back. Operator does the same analysis but pulls live rent comps automatically, stores every deal you've evaluated, and continues monitoring your portfolio after purchase. When market rents shift or expenses change, Operator updates your numbers. A spreadsheet shows you a snapshot; Operator shows you a moving picture. $25/month.