What Is a Good Cash on Cash Return for Rental Property?

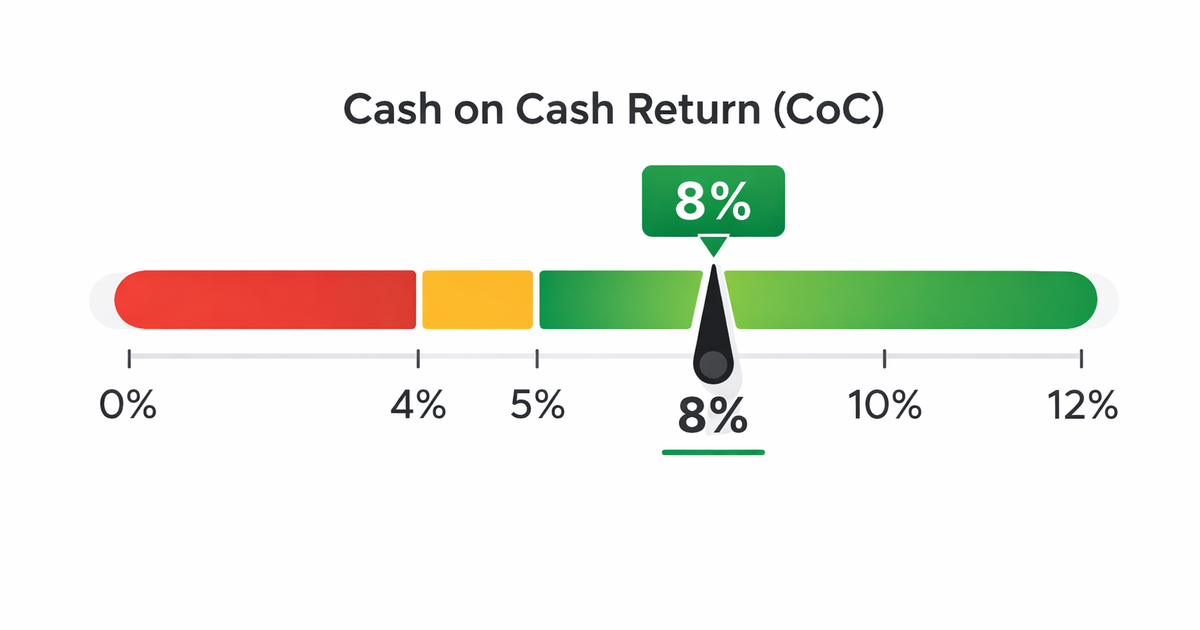

A good cash on cash return for rental property is 8-12%; this means your annual cash flow equals 8-12% of the total cash you invested, beating stock market averages while accounting for the added effort and risk of real estate.

What Cash on Cash Return Measures

Cash on cash (CoC) return measures how hard your invested dollars work.

Formula: (Annual Pre-Tax Cash Flow ÷ Total Cash Invested) × 100

Example:

- You invest $50,000 (down payment + closing costs + initial repairs)

- Property generates $5,400/year in cash flow ($450/month)

- Cash on cash return: $5,400 ÷ $50,000 = 10.8%

Your $50,000 earns 10.8% annually in pure cash flow, not counting appreciation, principal paydown, or tax benefits. Use our rental property calculator to run your own numbers.

Why 8-12% Is the Target Range

Below 8%, your capital earns similar returns in index funds without the headaches of tenants, maintenance, and vacancy. The S&P 500 has averaged 10% annually over the past 50 years.

At 6% CoC: You're accepting landlord responsibilities for stock market returns. The only justification is betting heavily on appreciation.

At 8-10% CoC: You're beating passive investments while building equity through principal paydown and potential appreciation. Reasonable risk-adjusted return.

At 12%+ CoC: Strong performance. Either you found an excellent deal, you're in a high-yield market, or your assumptions are too optimistic.

At 15%+ CoC: Double-check your math. Have you included vacancy, CapEx reserves, and realistic maintenance? Projections above 15% usually collapse to 10% in reality.

Cash on Cash by Market Type

Different markets produce different CoC expectations:

In Memphis, you can find 12% CoC properties because purchase prices are low relative to rents. In San Francisco, even 5% CoC is rare because prices are astronomical relative to rents.

Neither is inherently better. Cash flow markets generate income now. Appreciation markets bet on equity growth later. Your strategy should determine your market.

What Affects Cash on Cash Return

1. Purchase Price Relative to Rent

The lower your purchase price relative to rent, the higher your CoC. This is why the 1% rule exists: properties meeting 1% rent-to-price typically generate 8%+ CoC.

2. Down Payment Size

Larger down payments lower your mortgage payment and increase cash flow, but they also increase cash invested. The effect on CoC depends on your interest rate.

Example at 7% rate:

More down = more cash flow but also more capital at risk. At current rates, 25% down often hits the sweet spot.

3. Interest Rate

Higher rates kill cash flow. A property that generated 12% CoC at 4% rates might generate 6% CoC at 7% rates, same property, same rent, same purchase price.

The math: Every 1% increase in mortgage rate reduces monthly cash flow by roughly $60-70 per $100,000 borrowed.

4. Operating Expenses

Property taxes, insurance, and HOA fees vary wildly. A $150,000 property in Texas (2.5% property tax) has $3,750/year in taxes. The same property in Arizona (0.6% tax) has $900/year. That's $2,850/year difference, potentially 5-6% swing in CoC.

5. Your Vacancy and CapEx Assumptions

If you model 0% vacancy, your CoC looks great. Reality delivers 5-8% vacancy in most markets. For the full expense picture, see our guide on how to analyze a rental property. Same with CapEx; ignoring reserves inflates CoC projections.

I've watched investors claim 15% CoC on paper, then complain about "unexpected" expenses eating their cash flow. The expenses weren't unexpected. The projections were unrealistic.

Calculating Cash on Cash: Complete Example

Property: $180,000 purchase, $1,600/month rent

This property doesn't cash flow at current rates with full expense loading. Either negotiate a lower price, find higher rent, or walk away.

Use our cash on cash calculator to run your own numbers.

When to Accept Lower Cash on Cash

A sub-8% CoC isn't automatically a bad deal. Consider:

Strong appreciation potential. A 5% CoC property in a market growing 8% annually builds wealth through equity. In 5 years, appreciation may dwarf cash flow. Measure the full picture with equity multiple: it captures total return including cash flow and sale proceeds.

Exceptional quality. A newer property in an A-class neighborhood may generate lower CoC but deliver lower vacancy, better tenants, and fewer repairs. Total return matters more than cash flow alone.

Tax benefits. Depreciation, mortgage interest deductions, and potential 1031 exchanges add returns that CoC doesn't capture.

Portfolio diversification. Your 8th property might be a 6% CoC deal in a different market to reduce geographic concentration.

But be honest with yourself: if you're accepting 5% CoC, you're making an appreciation bet. If appreciation doesn't materialize, you underperformed passive index funds while doing landlord work.

Tracking Actual Cash on Cash

Projected CoC is a guess. Actual CoC is reality.

Track every property's real cash flow against original investment using a cash flow analysis. After year one, calculate:

Actual CoC = Actual Cash Flow ÷ Total Cash Invested

I've had properties project 10% CoC and deliver 12% (lower vacancy than expected). I've had properties project 10% and deliver 6% (higher repairs, slower rent growth).

Operator tracks actual income and expenses so you see real CoC across your portfolio, not what you hoped for, but what actually happened.

FAQ

What is a good cash on cash return on rental property?

A good cash on cash return is 8-12% for most rental properties. Below 8%, your capital could earn similar returns in passive index funds. Above 12% is excellent but verify your assumptions; projections above 15% often use unrealistic vacancy or expense estimates. Cash flow markets like Memphis and Cleveland typically yield 10-14%, while appreciation markets like Austin or Denver yield 3-7%.

How do you calculate cash on cash return?

Cash on cash return = (Annual Pre-Tax Cash Flow ÷ Total Cash Invested) × 100. Annual cash flow is rent collected minus all expenses including mortgage, taxes, insurance, management, vacancy, repairs, and CapEx reserves. Total cash invested includes down payment, closing costs, and any initial repairs or improvements.

Is 7% cash on cash return good?

A 7% cash on cash return is acceptable but not strong. It slightly underperforms long-term stock market averages (10%) while requiring active management. At 7% CoC, the deal may still make sense if the property offers strong appreciation potential, below-average vacancy risk, or significant tax benefits. In high-cost coastal markets, 7% CoC may be above average.