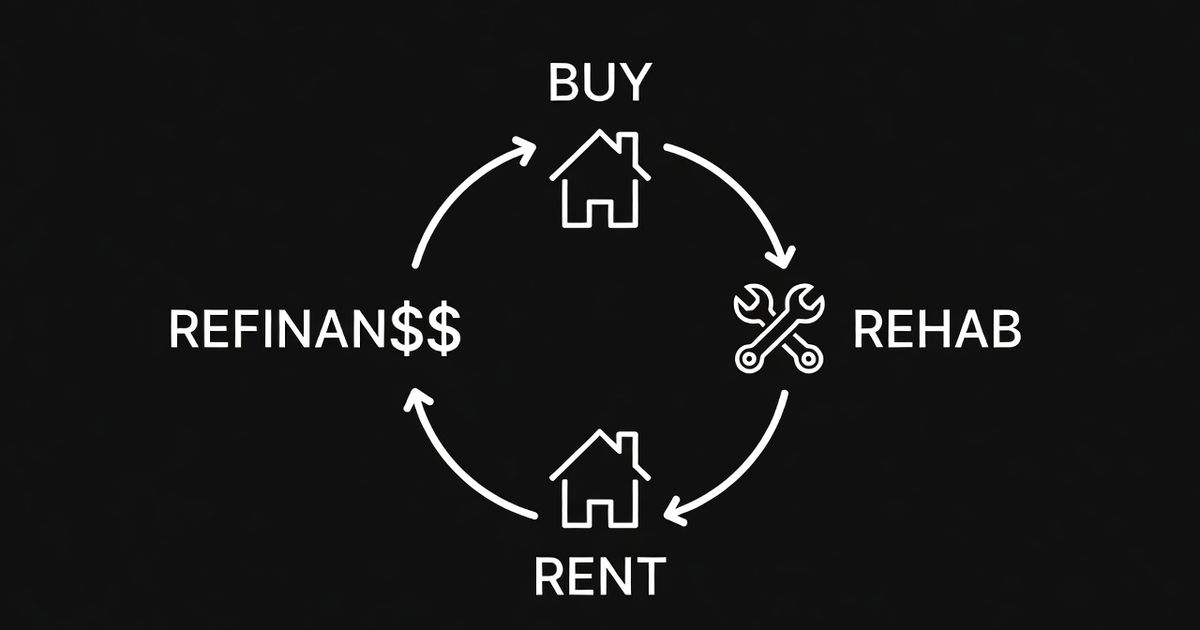

What Is the BRRRR Method? The Complete Strategy Explained

BRRRR stands for Buy, Rehab, Rent, Refinance, Repeat, a real estate investment strategy where you purchase distressed properties below market value, renovate them, rent them out, refinance to pull out your invested capital, and repeat the process with the same money.

How BRRRR Works: Step by Step

Step 1: Buy Below Market Value

Find a distressed property selling for 60-75% of its after-repair value (ARV). This discount comes from motivated sellers, foreclosures, inherited properties, landlords tired of problem tenants, or owners who can't afford repairs.

Example: A property worth $200,000 fully renovated sells for $140,000 because it needs $30,000 in work and the seller wants out fast.

Step 2: Rehab to Market Standards

Renovate the property to rentable condition. Focus on high-ROI improvements: kitchens, bathrooms, flooring, paint, and curb appeal. Don't over-improve, you're creating a rental, not your dream home.

The 70% rule: Your purchase price plus rehab costs should total no more than 70% of ARV.

$140,000 purchase + $30,000 rehab = $170,000 all-in $200,000 ARV × 70% = $140,000 maximum

This deal is slightly over at 85% of ARV. You'd need to negotiate a lower purchase price or reduce rehab scope.

Step 3: Rent at Market Rate

Place a qualified tenant at market rate, use a comparable market analysis to price the unit correctly. Lenders typically require 6-12 months of rental history before refinancing, though some allow refinancing immediately after rehab (called "delayed financing").

Step 4: Refinance to Pull Out Capital

Once the property is stabilized and appraised at ARV, refinance with a cash-out loan at 70-75% LTV. Many investors use a DSCR loan for this step since it qualifies on property income rather than personal income.

Example:

- ARV (appraised value): $200,000

- Cash-out refinance at 75% LTV: $150,000 loan

- Your all-in cost: $170,000

- Capital left in deal: $20,000

You recovered $150,000 of your $170,000 investment. Some deals let you pull out 100%, meaning you have no money in the deal and infinite cash-on-cash return.

Step 5: Repeat

Use the $150,000 to buy your next distressed property. Repeat the process. Instead of saving $30,000-50,000 per down payment over 2-3 years, you recycle the same capital every 6-12 months.

BRRRR Math: A Full Example

Result: You own a $210,000 property generating $250/month cash flow with only $5,100 of your capital tied up. Cash-on-cash return: 59%.

Compare to buying the same property conventionally:

- Down payment (25%): $52,500

- Closing costs: $6,000

- Same $250/month cash flow

- Cash-on-cash return: 5.1%

BRRRR delivers 10x the return on invested capital.

Why BRRRR Accelerates Portfolio Growth

Traditional buy-and-hold requires saving a new down payment for each property, typically $30,000-60,000 every 2-3 years.

BRRRR recycles capital. With $150,000, you could:

Traditional approach: Buy 2-3 properties over 5 years

BRRRR approach: Buy 5-8 properties over 5 years, using the same $150,000 repeatedly

The properties compound. Five BRRRR deals generating $200/month each = $1,000/month cash flow plus $1,000,000+ in real estate controlled with one pool of capital.

What BRRRR Requires

BRRRR isn't passive. It requires:

Deal-finding skills. Distressed properties don't appear on Zillow at 70% of ARV. You need to source off-market deals through direct mail, driving for dollars, wholesalers, or foreclosure auctions.

Rehab management. You're coordinating contractors, managing timelines, and controlling budgets. Rehab overruns kill BRRRR returns.

Short-term financing. Banks won't give you a 30-year mortgage on a property that needs $40,000 in work. You need hard money loans (10-14% interest) or private money to fund the purchase and rehab. These loans are expensive, so you need to complete rehab quickly.

Accurate ARV estimation. If you estimate ARV at $200,000 but it appraises at $170,000, you can't pull out as much capital. Your money stays trapped in the deal.

Refinance-ready properties. The property must appraise at your projected ARV and meet lender requirements. Unpermitted work, title issues, or appraisal problems can derail the refinance.

Where BRRRR Fails

I've done 6 BRRRR deals. Four worked. Two didn't.

Deal #4: Rehab ran $18,000 over budget because I missed foundation issues during inspection. My all-in cost exceeded 85% of ARV. I only pulled out 60% of my capital instead of 100%.

Deal #6: The appraisal came in $25,000 under my ARV estimate. Same result: capital trapped.

Common failure points:

- Overpaying for the property (no margin for error)

- Underestimating rehab costs (always add 15-20% contingency)

- Overestimating ARV (use conservative comps)

- Rehab taking too long (hard money interest eats your margin)

- Appraisal issues (different appraiser = different value)

BRRRR works when you're conservative on every input. It fails when you stretch to make deals work on paper.

BRRRR vs. Traditional Buy-and-Hold

BRRRR is a tool for building portfolios faster. It's not mandatory. Plenty of successful investors buy turnkey properties and scale slowly. Choose based on your time, skills, and risk tolerance.

Running BRRRR Numbers

Before making an offer, model every BRRRR deal with a rental property calculator:

- Purchase price + rehab + holding costs = all-in cost

- ARV estimate (conservative; use lowest reasonable comp)

- Refinance proceeds at 75% LTV

- Capital remaining after refinance

- Projected cash flow with new mortgage

Use our BRRRR calculator to run scenarios quickly. If the numbers don't work at your offer price, walk away, don't stretch to make a deal fit.

FAQ

What does BRRRR stand for in real estate?

BRRRR stands for Buy, Rehab, Rent, Refinance, Repeat. It's an investment strategy where you purchase distressed properties below market value, renovate them, rent them to tenants, refinance with a cash-out loan to recover your invested capital, and repeat the process with the same money.

How much money do you need to start BRRRR?

Most BRRRR deals require $50,000-150,000 to cover purchase, rehab, and holding costs before refinancing. Hard money lenders may fund 80-90% of purchase and rehab, reducing your out-of-pocket requirement to $20,000-50,000 per deal. After refinancing, you recover most or all of this capital to use on the next deal.

Is BRRRR better than regular rental investing?

BRRRR is more capital-efficient than traditional buy-and-hold, you can acquire more properties with the same capital by recycling your investment. However, BRRRR requires more time, skill, and risk tolerance. It involves finding distressed properties, managing renovations, and depending on accurate appraisals. Traditional investing is simpler but scales slower.